Educating the People about what is possible with modern public money systems.

Are you tired of hearing that a better world is unaffordable?

So are we. Let’s change the narrative together.

Our mission at Modern Money Lab U.S. is to educate people about what is possible with a basic understanding of how money works.

The dominant story about money is false. Most economists, politicians, and media people talk about money as if it is a scarce commodity.

But in reality, money is neither scarce nor a commodity. Money is an institution and a public good that We the People can design to serve a public purpose.

The true story of money is not as complicated as you'd think. It just gets less attention than the one that powerful people use to deny working-class people the means to a dignified life.

A more fair and sustainable economy is within reach if enough of us can team up to bust the old myths about money.

We employ multiple approaches towards this goal:

01

Hosting events and workshops around the United States

02

Sharing educational resources

03

Connecting people and organizing discussions

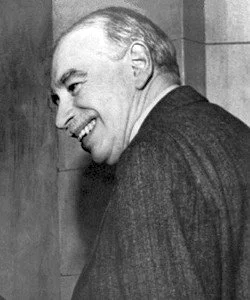

John Maynard Keynes, 1942

“Anything we can actually do, we can afford.”

The United States is self-financing.

Finding the money is never the problem.

Modern Money Lab seeks to broaden popular understanding of how America’s public money institutions work. By doing so, we seek to encourage a more informed and productive national conversation about responsibly stewarding these money systems for shared prosperity.

For any federal policy, “How are you gonna pay for it?” is the wrong question. Instead, we should ask: How do you resource it? Or, how do we design it to reach the desired outcome in the real world?

Building a better world is not about how we pay for it. It’s about how we do it.

Ben Bernanke, Former Federal Reserve Chair

“It’s not tax money… To lend to a bank we simply use the computer to mark up the size of the account they have with the Fed… It’s much more akin to printing money than it is to borrowing.”

Money is a public good.

Public money allows the private lending system to function. Without enough federal dollars flowing into the economy, liquidity shortages lead to economic downturns, unemployment, and financial crises regardless of (and often due to) any bank’s ability to make loans in US dollars at its discretion.

At the same time, no amount of federal dollars on its own can resolve supply chain issues, or a shortage of goods or services. The only hard constraint on federal investment, and the primary sources of real-world inflation, are physical resources – not federal taxes or bonds.

An understanding of public money as an institution and a public good widens the horizon of policy options and strengthens efforts for building a better world. From this basis of understanding, policy decisions become clearer. We can do better at controlling inflation than using a single interest rate. Unemployment is a policy choice, not an economic necessity. We don’t need rich people’s money to fund anything. We need to tax the rich simply because they are too rich.

Money follows our rules, not the other way around.

Once enough people see money for what it is – a versatile public institution, not a scarce commodity – we can start to build an economy that is more fair, resilient, and prosperous for everyone.

Alan Greenspan, Former Federal Reserve Chair

"The United States can pay any debt it has because we can always ‘print’ money to do that."